What is ROI in Real Estate?

Best Off-plan ROI real estate in Dubai is quickly becoming the best way for investors to make a lot of money in 2025. Off-plan investments are a great way to get a high return on your money while minimizing the amount of money you have to pay up front. They offer affordable entry points, payment plans that are spread out over time, and a high chance that the property’s value will have increased by the time it’s delivered. In Dubai, where both residential and commercial projects are constantly growing, off-plan projects are being used by smart investors to make money and grow their portfolios.

Why Off-Plan Investments Matter in 2025

In 2025, there is a strong rise in off-plan transactions in Dubai’s ROI real estate market. Off-plan sales now make up more than 60% of all property deals, according to the Dubai Land Department (DLD). This trend shows that investors are confident, the government is backing the projects, and the pre-construction opportunities are making money.

Key Drivers of Best Off Plan ROI:

- Lower entry prices compared to ready properties

- Flexible payment plans stretching over 3–7 years

- High potential for capital appreciation before and after handover

- Investor-friendly laws and escrow account protection

- Demand from short-term rental markets and resale opportunities

Capital Appreciation: Profit Before Handover

Off-plan buyers are in a strong position to realize gains even before taking possession of the property. Due to rapid infrastructure growth and rising demand in areas like Dubai South, Meydan, and JVC, capital appreciation between booking and handover can be substantial.

Key Factors Contributing to Capital Appreciation:

- Upcoming infrastructure projects (e.g., Dubai Metro extensions, new malls, schools)

- Developer reputation and phased pricing

- Scarcity of inventory in prime or near-prime locations

- Anticipation of area-wide masterplan completion

Sample Appreciation Rates (2023–2025 Data):

- Dubai Hills Estate off-plan units: Appreciated 15–20% between launch and handover

- Emaar South townhouses: Rose by 12–18% in two years

- Meydan off-plan apartments: Increased 10–15% in pre-completion secondary resale value

Capital Gains Before Completion:

- Investors often flip off-plan properties in the secondary market, particularly after the 30–40% payment mark, resulting in double-digit profits without full payment.

Payment Plans: Best Off Plan ROI Through Cash Flow Efficiency

Unlike ready properties that require full payment or heavy financing, off-plan projects come with flexible, phased payment plans. These plans are designed to make ownership easier and free up cash flow for investors to diversify portfolios or reinvest early gains.

Common Payment Plan Structures:

- 60/40 or 70/30 Post-Handover Plans: Pay only 30–40% during construction, rest over 2–3 years post-handover

- 1% Monthly Installments: Especially popular among mid-market developers like Danube or Samana

- Milestone-Based Plans: Pay based on construction progress (e.g., 10% booking, 20% during structure, 30% on handover)

Best Off Plan ROI Advantage of Structured Plans:

- Reduced upfront capital = lower opportunity cost

- Resale before handover = capital gains with partial investment

- Post-handover rental income can cover remaining installments, enhancing yield

How to Maximize Best Off Plan ROI: Strategies That Work

To achieve the highest return from off-plan investment, investors need to look beyond pricing and adopt a strategic selection process that includes location, developer credibility, future demand, and resale liquidity.

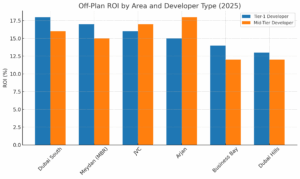

1. Choose High-Growth Zones

Select communities where prices are still affordable, but future infrastructure or demand will drive appreciation. Centurion properties helps you navigate through the High-Growth Zones

Top 2025 Picks:

- Dubai South: Near Al Maktoum Airport and Expo City

- Meydan (MBR City): Central location, luxury positioning

- Arjan: Budget-friendly with upcoming schools and hospitals

- JVC/JVT: Established rental market, continued growth

2. Monitor Project Phases

- Phase 1 launches are priced lowest and offer best ROI

- Avoid investing in oversupplied zones unless tied to unique demand sources (e.g., tourism, education hubs)

3. Evaluate Resale Restrictions

Some developers place resale conditions (e.g., minimum 40% payment completed), so plan exit strategy in line with these terms.

Comparing ROI: Off-Plan vs Ready Property

| Aspect | Off-Plan | Ready Property |

| Entry Price | Lower (20–30% below market) | Market price or above |

| Capital Appreciation | High (pre- & post-handover) | Moderate |

| Rental Income | Post-handover only | Immediate |

| Cash Outflow | Staggered | Upfront or mortgage |

| Flexibility | High (resale, post-handover plans) | Limited by finance/mortgage terms |

| ROI (2025 avg.) | 10–20% annually (combined gains) | 5–8% (net rental + appreciation) |

Risks and How to Mitigate Them

While off-plan investments offer strong ROI potential, they come with certain risks:

1. Project Delays

- Mitigation: Invest with DLD-approved developers; verify escrow compliance

2. Over-Commitment

- Mitigation: Choose payment plans aligned with income/cash flow

3. Market Correction

- Mitigation: Avoid speculative flipping; invest in projects with real end-user demand

4. Limited Resale Liquidity

- Mitigation: Ensure property has strong location, views, and brand reputation

Winding Up

Off-plan investments in Dubai are no longer just a risky bet; they are now a well-regulated, developer-backed way for modern investors to get the best return on their money. Investors can get double-digit annualized returns with lower risk and better exit options if they pick the right project, enter at the right time, and use flexible payment structures.